MAY 21 - MAY 22, 2024

Hilton Downtown Nashville, Tennessee

Unrivalled new business and deal origination opportunities for the American digital infrastructure finance community

We brought you access to the hottest deals in digital infrastructure finance across the US!

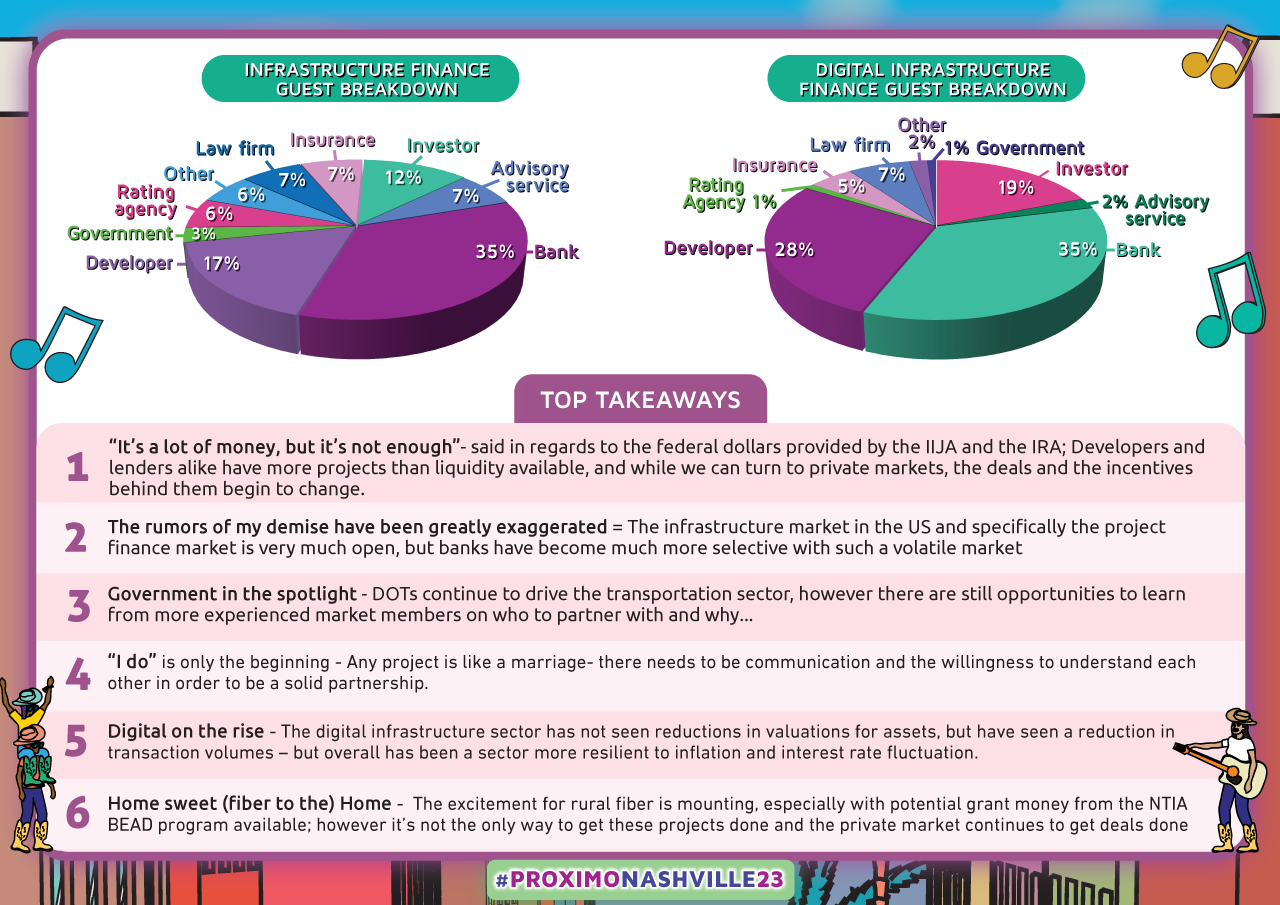

Key Takeaways from the event:

1. Challenges and Opportunities in Infrastructure Transition: Managing technology and stranded asset risks, especially with the transition to electric fleets and renewable energy sources, is crucial. Financial sponsors are cautious about investing in technology that may become obsolete or unprofitable. Sponsors have become even more focused on long-term megatrends like decarbonization, digitalization, and sustainable mobility. Investors expect these trends to withstand short-term volatility, and are seen as critical for future infrastructure investments.

2. Interest Rate Signals: There's a consensus that interest rates might go down eventually, but it's uncertain when exactly this will happen due to varying factors like inflation and upcoming elections. The debt market believes we are at or near the top of the current rate cycle, affecting long-term borrowing and investment strategies. While fixed-rate debt borrowing has become less attractive in high-rate environments, opportunities remain based on relative value.

3. Sectors Driving Activity: Digital infrastructure, especially data centers, is currently witnessing significant activity. Deals in the data center space are becoming increasingly large and frequent, driving demand for both human and financial resources. Additionally, sectors like fiber networks and towers are also quite active, showing a shift towards digital transformation and infrastructure investments. On the core infrastructure side, toll roads remain a resilient sector and there has been a marked increase in competition among large developers, especially in the US market

4. Liquidity and Funding Sources: There is ample liquidity in the market for the right projects, with different sources like private credit, ABS (Asset-Backed Securities), and CMBS (Commercial Mortgage-Backed Securities) contributing to funding availability. However, sectors like renewable energy and digital infrastructure require careful consideration given their unique risk profiles and funding needs. There is a noted increase in competition between tax-exempt markets and private investors for major projects, leading to dynamic capital allocation decisions.

5. Demand for Data Centers and Infrastructure Financing: The demand for data centers, particularly driven by the rise in AI and hyperscaler requirements (companies like Amazon, Google, and Microsoft), is skyrocketing. This demand is expected to double the current capacity in the next five years. The financing models for these centers have matured, evolving from real estate to more structured project finance models that attract both equity and debt investors.

6. Challenges in the Fiber Market: The fiber market, especially Fiber to the Home (FTTH) in the US, faces significant challenges. Competition among broadband providers, including fixed wireless and legacy cable companies, is a major hurdle. Additionally, supply chain constraints, including a skilled labor shortage and equipment availability, are complicating infrastructure development. There's also an underlying concern regarding higher costs and penetration risks compared to international counterparts.

7. The “Wild Wild West” of Power: The power demands from AI are severely underestimated, and the path to meeting these demands will be incredibly difficult with current constraints on the market from financing to transmission.

8. Evolving Financing and Investment Strategies: Macroeconomic conditions like high inflation and interest rates are influencing financing strategies. Despite these conditions, there remains a strong momentum in infrastructure investments. Insurance companies and pension funds are becoming more involved in providing long-term capital. Flexible business models and creative financing solutions, such as private ABS, are gaining traction, allowing for greater adaptability in a fluctuating economic landscape.

Our Clients

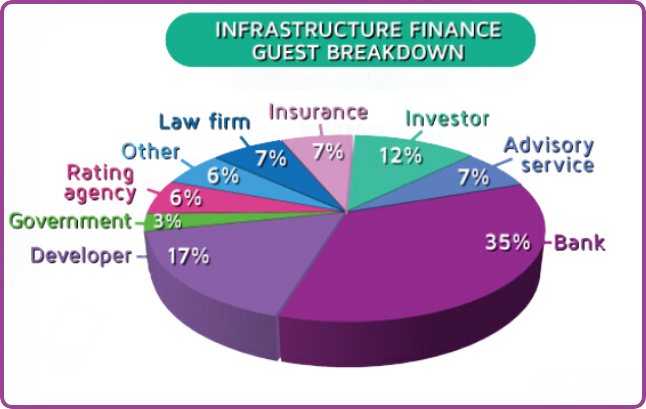

2023 Attendees

- Aecom

- Aligned Data Centers

- ASTM North America

- Bernhard

- Central States Tower

- Compass Datacenters

- Edgemoor Infrastructure & Real Estate

- eStruxture

- Fengate

- h5 data centers

- Greystar

- InVolta

- IQ Fiber

- JLC Infrastructure

- JLL

- John Laing

- Kiewit

- Nova Clean Energy

- Tillman Digital Cities

- Actis

- Alliance Bernstein

- Allianz Capital Partners

- American Triple I Partners

- Amico Infrastructure

- Antin Infrastructure Partners

- Ardian

- Astatine Investment Partners

- Astra Capital Management

- Atlanta Ventures

- Australian Super

- AustralianSuper

- Aviva Investors

- Brookfield

- Carlyle Global Infrastructure

- Equitix

- GI Partners

- GIC

- Grovecourt Capital Partners

- iCON Infrastructure Canada Inc.

- Igneo Infrastructure Partners

- KKR Capital Markets

- LGIMA

- Metlife

- Nuveen

- Partners Group

- PIMCO

- Prudential private capital

- SLC Management

- Tikehau Star Infra

- Ullico Infrastructure

- Vauban Infrastructure Partners

- ANZ (Australia and New Zealand Banking Group)

- Bank of America Merrill Lynch

- BMO Capital Markets

- CaixaBank

- CIBC

- CIT Bank

- Citi

- Credit Agricole CIB

- Deutsche Bank

- Goldman Sachs

- Harrison Street

- ING Bank

- ING Capital

- Intesa San Paolo

- JP Morgan

- Macquarie

- Macquarie Capital

- Macquarie Group

- MUFG

- MUFG Global Corporate & Investment Banking

- Siemens Bank

- SMBC

- Société Générale

- TD Asset Management

- Truist

- U.S. Bank

- Allen & Overy

- Bryan Gonzalez Vargas & Gonzalez Baz

- Cahill Gordon & Reindel LLP

- Chapman and Cutler

- Gibson Dunn

- Greenberg Traurig LLP

- Mayer Brown

- Paul Hastings

- White & Case

- Infrastructure Canada

- U.S. DOT - Build America Bureau

- US Department of Commerce

- Agentis Capital

- AIMM

- Altus Group

- Assured Guaranty

- AXA XL

- Broadband Success Partners

- Cavnue

- Chatham Financial

- Cohn Reznick

- CohnReznick LLP

- DC Advisory

- Delaware Trust

- Fitch Ratings

- Fitch Ratings Ltd.

- HNTB

- Javalyn Partners LLC

- Kroll Bond Rating Agency Inc.

- Mazars

- Q Advisors

- S&P Global Ratings

- WTW

Venue

Nashville 2024 will take place at the wonderful Hilton Downtown Nashville in Tennessee!

121 4th Ave S, Nashville, TN 37201, United States

TAXI - 10 minutes from Nashville International Airport

TRAIN - 48 minute journey

Please contact Danielle Lall if you have any questions about the venue.

To book your room, visit the accommodation section and book via the link --->

Accommodation

We have arranged an exclusive discounted hotel room rate for attendees of Proximo Nashville 2024!

Book your room at the event hotel now for $309.00 per night (available 19-22 May).

Limited availability, rate valid until 29th April. Click here to book now.

Networking Activities

We will be hosting networking activities for all delegates attending Proximo Nashville , offering everyone an opportunity to have a drink and network outside of the event. As is tradition, this will include ice-breaker drinks on the evening of 4th March. Details to follow!

For more information on our event logistics please contact us

Email us